Whether you own your own home or not, you can’t help but know about the subprime mortgage crisis that is sweeping across America as foreclosures are claiming people’s homes everywhere we look.

Well, almost everywhere. Even in light of the foreclosure epidemic and what appears to be a looming economic recession, it seems to be that New York City—especially Manhattan—is immune to the kinds of mass foreclosures and repossessions that are plaguing the rest of the country.

“It has impacted it in the way that it’s a little more difficult to secure a loan, especially in a co-op, but that being said, the market is still strong here,” says Colleen Dwinell, a sales agent at DJK Residential. “We are insulated here in Manhattan, and because there are so many co-ops and the co-op boards are so strict, the people who got in are very qualified and you don’t really see that foreclosure monster anywhere near us.”

In fact, condos and co-ops in Manhattan continue to thrive, despite a downturn on Wall Street and a declining housing market nearly every other part of the country.

“Manhattan has been fairly isolated from the subprime meltdown because very few subprime loans are issued to Manhattan borrowers,” says Vicki Been, director of the Furman Center for Real Estate and Urban Policy. “In 2006, only 0.8 percent of new home purchase loans in Manhattan were subprime, compared to 19.7 percent citywide.”

Help for Affected Homeowners

But not so all over. The situation in some of New York City’s boroughs, particularly Queens and Staten Island, has gotten so dire it has attracted the attention of the judicial system. According to the New York Times, homeowners in New York who face foreclosures would be offered help by the courts to save their homes or at least make the overall process easier under a new program announced recently by the state’s chief judge Judith S. Kaye. The program calls for the creation of a new section of the court charged with helping borrowers and lenders reach speedy settlements. Homeowners would be notified almost immediately that they face a foreclosure proceeding; they would receive a list of legal and foreclosure counselors who can help them; and they would be invited to court for a settlement conference. According to court data, foreclosure filings across the state have increased by 150 percent since January 2005, and according to Judge Kaye, in Queens, the figure is an astronomical 223 percent. An additional increase of 40 percent is expected by the end of 2008.

According to Realty Trac, an organization that tracks foreclosures and assorted property data, the Bronx reported 246 foreclosures in April or 1 for every 2,048 housing units; Kings County, which includes Manhattan, 648 foreclosures or 1 for every, 1,472 housing units; Richmond County, which includes Staten Island, 293 foreclosures or 1 for every 605 housing units; Queens County, 924 foreclosures or 1 for every 900 housing units; Nassau County, 502 foreclosures or 1 for every 912 housing units; and Suffolk County, 731 foreclosures or 1 for every 742 housing units.

Economic Downturn

No one is denying that these are sluggish times for our economy, and Wall Street is definitely feeling the effects. Bonus money—long a predictable factor in luxury apartment purchases—has been in decline for a couple of years, and many companies are laying off employees. Still, experts don’t believe that this will spell anything like doom for the co-op and condo market.

“It won’t—and I’ll tell you why,” offers Michael Signet, executive director of sales for Bond New York, a brokerage firm specializing in both sales and rentals. “The subprime mess occurred because banks were supplying mortgages to people with questionable credit and allowing them to put down the bare minimum in down payments, sometimes as little as five percent. As soon as the adjustable mortgage went up, [those borrowers] were no longer able to make the payments, and they needed to sell. As that scenario occurred repeatedly, the inventory grew and the prices dropped and they couldn’t sell for what they owed.”

But in New York, says Signet, this didn’t happen. “Co-ops are a non-issue because they require 20 percent down and they require two years’ worth of what it will require to pay your mortgage and maintenance in liquid assets after closing, so there is very little risk,” Signet continues. “As far as condos, because New York City is generally an appreciating asset, they only need to cover 90 percent and they could still sell.”

Been agrees. “Stable price appreciation throughout the New York City’s market has meant that borrowers in distress are more likely to be able to sell their properties or refinance rather than face foreclosure,” she says.

Banks an Issue

The one area where this whole crisis does infringe on Manhattan to some degree is in financing. Because of all the problems that the subprime mortgages have brought about, banks have become much stricter in some areas of lending—even in Manhattan.

“The same way that it has impacted the entire mortgage industry, it certainly has impacted sales, because banks are not giving mortgages out as easily as they were before. They have set the bar higher,” says Mona Shyman, vice president of the Federation of New York Housing Cooperatives and Condominiums (FNYHC).

So borrowing has been made more difficult in some instances, but it would seem that because of who the New York buyer is, this doesn’t mean too much.

New Money Coming In

Since essentially all the new development going on in the city at the moment is in condos, buying into a new building doesn’t require the same money that the co-ops do and people with 10 percent down can generally get what they want. As long as they can secure financing (and even with the stricter banks, it’s still relatively easy for people to get their loans) the woes afflicting other markets may well never be visited on New York City.

“There are a lot of people from overseas coming over because they are getting so much more for their money—and we are seeing many more foreign investors coming into the market now,” says Dwinell. “The higher-end properties, the $5 million-and-up apartments, aren’t being affected at all. When we look at all the new developments out there, they are all selling out. The high-end new construction is selling.”

Shyman says that when it comes to these super-luxe properties, you have to remember that the buyers are in a whole different ballgame. Many of these buyers are paying without any financing at all, and she doesn’t see this sector hurting one iota.

“A lot will depend on November and the election,” she says. “But there will always be people who can afford these apartments.” Since co-ops are so strict in Manhattan, requiring 20 to 25 percent down and the means to pay the mortgage, most owners are more than qualified for purchasing and aren’t really affected by what’s happening, says Shyman.

Remember Where You Are

While the brokers aren’t feeling much downturn, many have been faced with buyers from out of state who are under the misconception that just because the housing market in their neck of the woods is bad, that it has carried over to Manhattan.

“The biggest issue we deal with in working with out-of-town buyers and the real estate market is that they find an apartment, and then [try to] negotiate the way they would in Maryland or Michigan or Idaho,” says Signet. “But despite what’s happening across the entire country, New York is immune and they can’t bring those formulas to the city. We have to do a lot of educating in advance when it comes to out-of-towners.”

The experts say there’s also a sort of domino effect with people selling their homes and attempting to relocate to Manhattan. Many people had homes they bought 30 to 40 years ago so when they sold, they had the money to buy a co-op or new condo.

“It used to be that people buying in Manhattan were coming in and writing a check and not even dealing with the mortgage situation,” Shyman says. “Now, the people behind you who are buying your house are not getting the mortgages, and that’s where the domino comes in. They can’t come up with the money.”

There is some belief that if the economy continues to decline, the developers will suffer, as they may be the ones who can’t get financing. In other words, there will be fewer developments, which will result in more demand. That could be beneficial to some.

“We are seeing a tremendous influx of foreign investors coming into this market now,” Signet says. “People are coming from everywhere and scooping up apartments everywhere in the city.”

Danger Signs

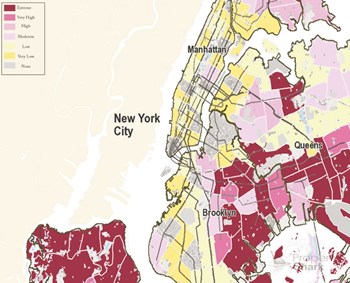

In recent years, homebuyers in New York (particularly those in the outer boroughs) have taken out subprime loans at rates higher than most other large cities and increasingly relied on piggyback loans.

“This risky borrowing has left many homebuyers highly leveraged and vulnerable to default,” Been says. “We have already begun to see a downturn in real estate prices in New York City. If this trend continues, the city may face serious challenges from increasing numbers of foreclosure filings.”

Dwinell doesn’t believe that Manhattan faces these challenges and expects everything to continue moving right along at a strong pace.

“Demand is still strong. Manhattan is a really exciting city for people to move to and different people are always coming into the market,” she says. “People downsizing from the suburbs, people coming from other countries. It has so much to offer and conveniences. Whatever is happening outside of the city is a whole other animal. This is the place you want to be.”

Keith Loria is a freelance writer and a frequent contributorto The Cooperator.

Comments

Leave a Comment