You've found your dream home at last. However, you don't have those hundreds of thousands stashed away

to pay for your new co-op or condo in cash. What do you do? Like most new home buyers, you apply for a mortgage. But as an individual you could drown in a sea of unfamiliar terms, little-known lenders and stringent bank requirements. That is why many co-op and condo buyers are turning to mortgage brokers to help them secure unit financing.

Until the interstate banking laws changed about ten years ago, says Neil Bader, chief executive officer of Skyscraper Mortgage Company, a mortgage brokerage firm that does about one out of every four co-op loans in New York City, only about two percent of buyers used mortgage brokers. Today, due to changes in the banking industry, more than 60 percent go through brokers.

The 1986 law that Bader refers to allowed banks to cross state lines and set up offices all over the country. As a result, it became too costly for banks to set up regional offices and do the community outreach that banks did in the old days. Instead, banks have turned to mortgage brokers to peddle loans for them. This has allowed many small, niche-market banks to become large co-op and condo lenders. But even so, the average consumer would probably not be famililar with many of them, even though they may offer the most competitive rates.

Obstacles to Financing

Not knowing which banks to go to is one of many obstacles the co-op or condo buyer may face. Some banks will not provide loans for co-ops at all. Some banks have an application quota and won't inform a potential borrower that they don't do co-op loans until their application has been turned down, explains Tom Barnhart, president of Manhattan-based Mortgage Commitments, a two-year- old firm specializing in co-op and condo mortgages. This is where using a mortgage broker comes in handy; we know which lending institutions will provide end loan financing for co-ops and condos.

If the bank does provide loans for co-ops, you still may have problems, says Michael Wielgus, vice president of sales for the residential division of Meridian Capital, a Brooklyn-based mortgage brokerage company. The first thing you want to find out is what the percentage of sold shares the bank requires. Most banks want 50 percent sold, while some want 75 percent sold. There are others that will be more lenient and only require that 35 percent be sold.

Most banks rely on secondary markets to fund their loans, and thus they have to meet the requirements set by lenders such as Fannie Mae, explains Bader. But there is a cadre of local banks that keep the loans in their own portfolios, so they can make their own rules. These banks, including the Independent Savings Bank of Brooklyn, the National Cooperative Bank, the Dime Savings Bank, Home Savings of America and Apple Savings Bank, have much more lenient rules when it comes to making co-op and condo loans and are willing to work with buildings that don't meet the tough criteria of loan resellers.

What Type of Mortgage?

There are basically two types of mortgagesfixed rate and adjustable rate. Fixed rate mortgages allow the borrower to lock in at a certain interest rate, guaranteeing that the monthly payments will remain the same for the life of the loan. An adjustable rate mortgage usually starts off with a lower ffb ratemeaning your monthly payment will be lowerbut the interest rate will be adjusted at pre-set periodic intervals, every year or two or three. Since the interest rate generally floats with the prime rate, if the rate goes up, your payments will also go up.

It is always a good and safe idea to lock in with a fixed rate, suggests Wielgus. Since the adjustable rate is based on the prime rate, you can't predict if that is going to increase or decrease. With the fixed rate you are safe even if it goes up.

It might also be a good idea to lock in at a fixed rate if you are applying for your first mortgage. Usually first time buyers are on a fixed budget and don't have a lot of cash on hand, explains Mitchell Steinberg of the Manhattan Mortgage Company, a registered mortgage brokerage firm that specializes in co-op and condo loans. This is always a safe bet and is easier to include in your budget. Because an adjustable rate mortgage is more risky, I recommend that only to those who have a lot of cash on hand because you never know how high the rate is going to go up.

The closing costs also play a large role in the type of mortgage you get, says Wielgus. Sometimes these closing costs can be as high as eight or nine percent of the total mortgage, so you have to be prepared to part with a large sum of money. Wielgus also stresses the importance of including the maintenance in the closing costs. A lot of people forget that when you move in you are required to pay the maintenance for the first month. So in addition to the closing costs, the borrower will also have to be sure to have enough money to cover the maintenance.

The Role of the Mortgage Broker

Pat Lyons just bought a co-op on the Upper East Side and used a broker to get her mortgage. I originally went to the bank that I usually do all my business with and was rejected for a loan because they did not lend to co-ops, she explains. After that I decided to try a broker and am convinced it was the best thing for me to do. The broker sat down with me and asked me all sorts of questions, not just about my financials but things pertaining to how long I intended to live in the apartment. This way we determined which type of mortgage was best for me. He also discussed all of the closing costs so I knew exactly what I was going to have to shell out.

Working with a mortgage broker is cheaper and you get better service, says Bader. He explains that as a mortgage broker, he has relationships with many different banks and lending institutions, which give him a discount on mortgage money. Where a client off the street might get a 30-year fixed mortgage at eight percent with two points, he would get the same with just one point (meaning a service charge of one percent of the full loan amount). From there, he will mark up the loan at his discretion, to 1.5 or two points. Thus, the cost of the loan will be equal to or even less than the client could get by going directly to the bank. He cautions, however, that some brokers may mark the loan up to higher than the going rate, so consumers must be sure they are working with a reputable broker.

The important thing to remember is that we can't affect the interest rates, explains Barnhart. What you do get is objectivity, because we don't work directly for the lenders.

A broker will take the time and go over all of the details with the borrower, says Steinberg. Often if a borrower gets a mortgage on his own he can get lost in the closing costs and feel overwhelmed by the whole process. By having a broker work with you, you can avoid a lot of the headaches involved when you go it alone.

Although I can't say 100 percent that there won't be any charges for the borrower, most of the time there won't be, says Barnhart. It depends on the type of loan the borrower gets.

Choosing a Mortgage Broker

There are no training courses to become a mortgage broker, Barnhart explains. There are so many nuances in this business that you have to learn a lot from experience. So you want to find a broker that has be ffb en doing this for a while. Someone with a lot of experience may also have a better relationship with lenders. Barnhart also suggests referrals from other people. Also make sure that you are comfortable with the broker. Make sure you like their style and that it fits yours, Barnhart adds.

People typically find a broker through their real estate broker or their attorney, says Bader. I discourage people from choosing a broker from the newspaper or the yellow pages, because then they are not accountable to anyone. Mortgage brokers cultivate relationships with real estate brokers and other professionals as a way to get referrals, and in order to protect these relationships, they want to give clients the best service they possibly can. Once you have chosen a broker, you may want to contact the New York State Banking Department to see if any complaints have been filed against him or his firm.

Getting a Mortgage

Once the broker is chosen, he will sit down with the buyer to determine exactly how much money will be needed. I want to make sure they get the best deal, says Barnhart. I go through a rigid set of questions that are designed to focus on the borrower and also get a credit report to help choose the best bank and terms possible. This way we can make sure that we get a loan completed the first time.

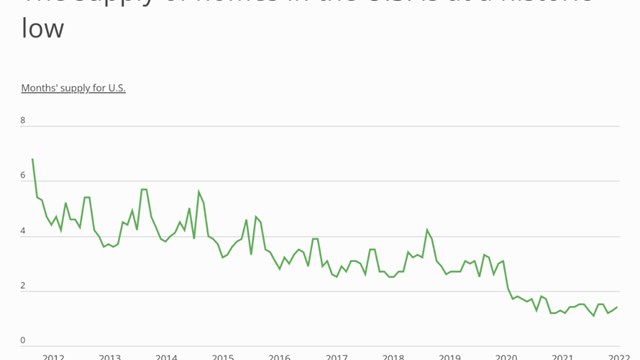

Getting a pre-approved mortgage is a preliminary step that can be taken to help the buyer compete better in today's tight seller's market. With demand far outstripping supply in New York's most desirable neighborhoods, pre-approval can give you the edge you need to get the apartment you want. The pre-approval process (not to be confused with pre-qualification, which is much more informal and noncommittal) is basically the same as the mortgage application process, only it is done before the buyer has settled on a specific property. For a fee, usually about $150, a bank will do a complete financial screening and, if the buyer qualifies for a mortgage, will issue a certificate stating how much the buyer is approved to borrow. Once the property has been decided on, the pre-approval can be quickly converted to an actual mortgage. This process is not only an excellent shopping tool, says Bader, but it also helps people to realize what they can afford.

Ms. Cooper is Editorial/Internet Coordinator of The Cooperator.

Comments

Leave a Comment