The New York State legislative season is here again, and bills of all kinds are being considered, including housing. Some of these bills directly impact co-op and condo board members, managers and residents. Housing is also on the agenda in the City Council.

As this article was being written, there were 224 bills before the Assembly for 2013-14 that related to housing (many of these bills also have counterparts in the state Senate). Many are specifically for rental housing—at least 20 specifically dealt with New York City Housing Authority projects. Some only dealt with one geographic area—for example, two addressed “towns in the Peconic Bay area.” Others could apply to both rental and co-op/condo housing—many of these are bills to help senior citizens.

Housing Bills

If you narrow the search criteria to “condo,” you’ll find only 45 bills. Yet, these bills (some of which also apply to co-ops) deal with important issues. For example, one bill, A00305, would mandate that in co-op and condo conversions, the majority of the board members must be shareholders or owners. Another, A00372, would establish a co-op/condo part in NYC civil court. Bill S02993, also A03010, relates to establishing “a new classification for properties held in condominium and cooperative form for assessment purposes” – a response to huge tax increases in Eastern Queens several years ago. And yet another, S02291, would enact a condo owner’s bill of rights.

If one searches for “co-op” only 10 bills come up. Bill A00940 would authorize the voluntary dissolution of Mitchell-Lama co-ops. There are four bills to prevent the warehousing of co-op apartments, a long-term problem in New York.

A search of the City Council website, on the other hand, showed few housing bills, and none specifically for co-ops or condos. Since co-ops and condos are governed by state legislation, bills dealing with them are usually found in Albany.

In February, most of the bills in Albany were still in committee—but not always in the Housing Committee. Furthermore, some have been introduced session after session, often with the same sponsors. Many times, at the end of each session, the bill is just reintroduced for the new session. An issue may seem unimportant one year, but could suddenly take on a new importance the next.

Several important issues have caught the eye of housing- and real estate-related organizations this year. For example, Mary Ann Rothman, executive director of the Council of New York Cooperatives and Condominiums (CNYC), says that of all issues, “The property tax is the most important of issues to our members.” In particular, she mentioned the J-51 property tax abatement for rehabilitating apartment buildings, including co-ops and condos. The legislature had allowed the program to expire. But in early February, Gov. Andrew Cuomo signed legislation revitalizing the program, giving buildings more incentives to make renovations and streamlining the program’s application process. “We’re very satisfied,” she said.

Michael Slattery, senior vice president of research for the Real Estate Board of New York (REBNY) says, “We are interested in Brownfield cleanup, which is good environmentally and economically. Such a site, once clean, can offer new opportunities for new housing.”

Those interviewed by this author believed that the recession has made some issues less prominent. One such issue, says Rothman, is the “written-rejection” bill, which would mandate co-op boards to tell applicants they’ve rejected why they were rejected. Related bills have given co-op boards only a certain time frame in which to act.

Written Rejections

The City Council recently held a hearing on one such proposal, Intro 188, sponsored by Brooklyn Councilman Lew Fidler, D-46, which would require action by boards and managing agents to respond to applicants in a timely fashion. The proposal also would call on board members to sign a certified statement saying that they did not unlawfully discriminate against a rejected buyer based on religion, race, nationality, etc., or one of the protected classes. Boards must inform buyers on the status of their application within 45 days.

Bills such as this one by Fidler have long been proposed over the years on the City Council level and in Albany but have had difficulty getting enough votes to pass.

Fidler, however, says now is the time to act. “I have been amongst other things a practicing attorney since 1979,” Fidler testified at the hearing. “I’ve represented buyers and sellers in cooperative apartment deals. No one is going to be able to tell me that discrimination, invidious discrimination does not take place in this process. No one is going to be able to tell me that co-op boards are not, as are every board, replete with personal and petty peccadillos. Sometimes interfere with the process.

“This bill does two things. First, it establishes a transparent and orderly system that people can count on so that discrimination can’t take place through the back door. You can’t just bury the application. I know that happens. Don’t tell me it doesn’t because I know it happens. And the second thing it does is require that the board members participating in the decision making process affirmatively assert that no unlawful discrimination took place in the process,” he says. Action on the bill is pending.

Although it is neither a state nor a city issue, another matter of concern to the housing community involves new Fannie Mae/Freddie Mac regulations. Among these regulations are provisions stating that buildings must have 10 percent or more of their funds set aside in a reserve fund, that no more than 15 percent of the units can be more than a month behind in maintenance or common charges, that the budget must include provision for insurance deductibles, and more.

“It is getting harder and harder for individuals to get mortgages or end loans because of the new FHFA (Federal Housing Finance Authority) rules,” says Greg Carlson, executive director of the Federation of New York Housing Cooperatives and Condominiums (FNYHC). “These rules were written for condos, and banks, because they do not know the difference between a co-op and a condo, are applying them to both. The dollars you have into the reserve are NOT a true test of building financial health,” he says. FHFA regulates Fannie Mae and Freddie Mac.

Finally, much has been made of moves being made by the city to encourage smoke-free buildings. “In the city, there is a rumor that the mayor wants to introduce in the Council a bill giving condos and condos the power to determine if, when and where smoking would be allowed in or around the project,” notes Carlson. “So far, no intro has been introduced.”

All in all, housing, real estate and co-op/condo organizations are generally opposed to new measures that would cost their members more money, “unfunded mandates,” or measures that would make the task of managing a building more difficult.

Representing Memberships

How do organizations represent their memberships and the community as a whole before the lawmakers? Interviews for this article show that the groups have varying approaches.

Slattery of REBNY says the organization “prepares the best arguments and information to advance bills that we think are important to our industry, the city and the state.”

Rothman says CNYC serves as a resource, making information available to legislators who need to know more about co-ops and condos and sometimes guiding them through the process. At times, she says, CNYC will let legislators know that a bill could impact the co-op and condo community negatively, even if the sponsors don’t mean it to do so. The organization’s members make their wishes known by letters and phone calls.

Carlson says that “organizations like the Federation take up issues that affect our members. On a good deal of these issues, we co-partner with other organizations for unity.”

Charles Achilles, vice president in charge of legislative affairs for the Institute of Real Estate Management (IREM), a national organization that has a New York chapter, told The Cooperator that each chapter has a legislative coordinator that heads a committee to work on state and local issues. The national office, he says, provides the local offices with “a number of tools,” some of which are on their web site (although some sections of this site are for members only). One important issue for IREM’s membership, Achilles said, is energy conservation, a pressing need that unites all of IREM’s managers—rental apartment managers, retail and office building managers, and, yes, co-op and condo managers.

Not all housing-related organizations, incidentally, are involved in trying to influence legislators. Margie Russell, executive director of the New York Association of Realty Managers (NYARM), says the group doesn’t put any of its assets into lobbying or trying to influence legislation. Its emphasis is on training apartment-building managers and certifying them. As part of this training, NYARM does keep these managers and prospective managers informed on new laws and regulations—and the new procedures that must be followed because of them.

What she’s concerned about, she says, is the growing workload resulting from the ever-growing number of laws and regulation. Almost no one, says Russell, decides to hire an extra manager because the manager’s workload becomes too heavy resulting from more laws and regulations.

Upstate-Downstate Cooperation

What’s the attitude toward co-op and condo legislation in Albany? After all, the co-op development, as we know it, is mainly found in New York City, although some are found in Westchester County and in New Jersey. This can lead to some confusion: “Most legislators,” says Carlson, “do not know the difference between co-ops and condos.”

Slattery responds that “Most people understand that taxing single-family homes differently than individual condo or co-op apartments is unfair.” Since his organization represents also realtors who deal with rental apartments, he adds, “It is also unfair that residential rental buildings pay taxes at a rate that is almost eight times greater than single-family homes.”

And although there are few co-ops outside the metro area, there are plenty of condos, especially in Rockland, Ulster and Suffolk and Westchester counties. Condo and HOA-based organizations exist throughout the state, and these, too, make their wishes known to the lawmakers.

In general, Upstate legislators are often likely to listen to the advice of their Downstate colleagues—people whom they’ve often worked with for years—on legislation that mainly concerns Downstate residents. Or, as Rothman put it, “Most Upstate representatives are willing to listen to their Downstate counterparts if it’s an issue that doesn’t cost the state a dime, like the J-51 tax abatement.”

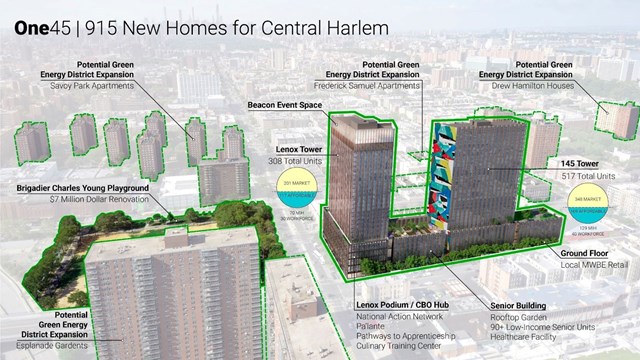

Turning from things specifically condo and co-op, affordable housing continues to be a big concern in New York. Mayor Bloomberg has a multi-faceted, evolving affordable housing plan, containing such measures as constructing new, privately developed affordable buildings on land owned by the New York City Housing Authority. One such building, a stone’s throw from this writer’s Chelsea residence, went up last year in a former parking lot used by residents of two neighboring city projects (the new building includes underground parking, which is available to project residents). The city also provides low-cost loans and grants to Mitchell-Lama housing developments that agree to stay in the Mitchell-Lama program.

Perhaps the best-known affordable housing program in the city is the 80/20 program, sponsored by both the state and the city. Tax-exempt bonds help to pay for the cost of large residential buildings. In exchange for the financing, 20 percent of the apartment units are reserved for tenants who earn no more than 50 percent of the neighborhood’s median income. “We continue to seek ways to encourage the production of affordable housing like the highly successful 80/20 program,” says Slattery. ‘However, we need to find additional ways to produce more affordable housing that is financially doable.”

Slattery also hopes that the pioneering use of “modular construction” (where individual modules are made off-site, then taken to the construction site and put together) by Forest City Ratner in Downtown Brooklyn and Mayor Bloomberg’s “micro-unit” plan will be catalysts for more affordable housing.

Finally, how is the recession affecting the housing measures being debated and voted on? Carlson says, “Sales of co-ops and condos are going strong, especially in Manhattan, where the lag effect for the other boroughs is one to two years.” Still, he worries that the aforementioned new federal lending regulations could hamper the recovery.

It’s also important to realize that large organizations like NYARM, CNYC, REBNY, IREM and FNYHC aren’t the only ones representing the interests of the housing community. Local organizations like the Brooklyn Co-op and Condo Coalition, the Association of Riverdale Cooperatives and Condominiums, and the Presidents Co-op and Condo Council in Eastern Queens are very active in pursuing their agenda with their city and state legislators. These groups can be very effective in advocating for local issues. For example, the President’s Council has been tireless in advocating against a spike in assessed valuations in their area, covered in past issues of The Cooperator.

Realtors, apartment managers, co-op and condo board members, unit owners and shareholders all have their own agendas, some of which overlap. But one thing is for sure. Wherever legislators get together, discussing their agenda, organizations representing these interests will be there, making sure that new legislation helps the interests of their members.

Raanan Geberer is a freelance writer and a frequent contributor to The Cooperator.

Leave a Comment