If you own a co-op or a condo, it goes without saying that you want to make sure you get all the tax credits and abatements available to you. One of the most important of those is the New York State School Tax Relief Exemption—more commonly known as STAR which provides a partial real property tax exemption for property owners on their primary residence.

“This is something that those in multifamily homes need to realize that they need to take care of,” says Eva C. Talel, a partner with the Manhattan-based law firm of Stroock & Stroock & Lavan. “It’s an important tax credit and one that is undergoing some changes this year. It’s important to follow the new registration guidelines.”

Some History

The STAR program was the brainchild of former Governor George Pataki, who in 1997 added it to his annual budget. The tax law was aimed at reducing school district property taxes on all primary residences of New York residents. The program does not affect the overall revenue of a given school district, as the difference is made up by the state.

As originally designed, the STAR rebate is subtracted from the “true value” of a home in question, which is determined at the time of the last property assessment (typically done by a town or county assessor), divided by an equalization rate, which is the ratio of assessed value to market value for each taxing jurisdiction, as calculated by the State of New York.

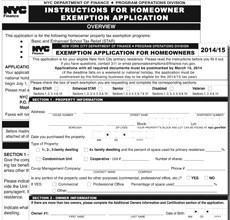

There are two types of STAR exemptions. Basic STAR is available for owner-occupied, primary residences where the resident owners and their spouses income is less than $500,000. In this case, the program exempts the first $30,000 of the full value of a home from school taxes.

Then there is Enhanced STAR, which provides an increased benefit for the primary residences of senior citizens (age 65 and older) with qualifying incomes, which exempts the first $63,300 of the full value of a home from school taxes as of 2013-14 school tax bills (up from $62,200 in 2012-13).

According to Glenn Newman, president of the New York City Tax Commission & Tax Appeals Tribunal, the STAR exemption provides about $280 of tax reduction each year.

While that may be some relief to a needy homeowner, it is not a lot of money. More substantial benefits are available to those over 65 years old if they have low income, are veterans or are disabled.

“Homeowners in New York City need to know about the STAR, Enhanced STAR, Senior Citizen, Veterans and Disabled Homeowners exemptions to help them manage the cost of maintaining their primary residences,” he says. “People should check the website of the NYC Department of Finance (www.nyc.gov/html/dof/html/property/property_owners.shtml) to determine their eligibility for these money-saving programs.”

The Tax Commission is the agency that handles protests of the denial or revocation of STAR and other personal exemptions.

“If a property owner wants to apply for a new STAR benefit, they must fill out an application and send it in to the New York City Department of Finance,” says Owen A. Stone, press secretary for the Department of Finance. “Approved applications received before March 15, 2014, will be eligible for benefits to begin on July 1, 2014.”

Changes to the Process

At the beginning of the year, New York Governor Andrew M. Cuomo signed into law a bill passed by the New York State Legislature amending the STAR program for residential co-ops and condos. The change affects exemptions beginning in 2014 and not the current year.

For the past 15 years, approximately 15 percent of all NYC condo and co-op residents benefited from the STAR program, but the new law allows owners to claim the tax break only on a primary residence, so the abatement is expected to help far less people.

According to Stone, this is the first time the state has done a registration program in the 15 years of the exemption, which about 2.6 million homeowners receive for a total savings of $1.9 billion.

“This year, there are requirements to register, a one-time only thing, and then the city will take the information from public records, so they shouldn’t have to do it again,” Talel says. “The STAR universe is contracting. I think it’s a general effort on the part of the city to increase revenue. The city wants to maximize the number of people who deserve to qualify by making this registration mandatory.”

The motivation, therefore, is to remove those who aren’t truly entitled to the tax credit but have continued to receive it year after year.

The Department of Finance sent letters to more than 120,000 of the city’s 360,000 co-op and condo owners earlier this year explaining the new rule. Stone explains it simply: If based on city records, the units are not being used as a primary residence or if there simply isn’t enough information to verify the fact, they would not be eligible.

Those owners had until April 12 to respond to the letter and prove that the apartment is their primary residence.

“More than 1.3 million homeowners have used our fast and easy registration process to ensure they don't lose their STAR exemptions,” Thomas H. Mattox, commissioner of New York State Department of Taxation and Finance, said in a governmental release this fall. “If you haven't registered yet, we encourage you to register today.” Last year, a Tax Department study identified thousands of property owners who were receiving more than one STAR exemption on multiple properties, resulting in the reasoning behind the new law.

According to Stone, the STAR program has always been a state program, but 2013 is the first time they are requiring recipients to register the exemption with the state. “The new legislation on co-op and condo tax abatement is a different matter,” Newman says. “The recent amendments will ensure the abatement is given to those whose primary residence is in NYC.”

Commissioner Mattox reminds homeowners that they must register with New York State even though they initially applied for Basic STAR with their local assessors.

When registering for the STAR exemption online, you’ll need to provide the STAR code that was mailed to you, confirm that the property is the primary residence of one of its owners, confirm that the combined income of the owners and their spouses who reside at the property does not exceed $500,000 and confirm that no resident owner received a residency-based tax benefit from another state.

“It takes between two to four minutes. Basically, they’ll provide their Social Security numbers, confirm that they’re not receiving STAR on another property, confirm that their income is below half a million dollars and they’re done,” Department of Taxation and Finance spokesman Geoffrey Gloak says. “You cannot do the process at the local assessor’s office.”

Senior citizens receiving the Enhanced STAR exemption are not affected by the new registration requirement. Seniors must, however, take steps to ensure they continue receiving Enhanced STAR. Seniors receiving Enhanced STAR who reside in New York City will be contacted by the New York City Department of Finance when they need to renew.

Getting the Money

When you live in a condo or co-op, the money doesn’t go directly to the unit owner, but to the building itself. It’s then up to the management company or building administration to disburse the money to the proper parties.

Newman says the abatement is paid in a lump sum directly to the building, and is required to be distributed to unit owners, but sometimes this is done by applying a credit, and other times the money is added to a reserve fund, keeping other resident costs down.

Talel adds that some boards traditionally issue an assessment to owners for about the same amount as the tax break and use that money to subsidize the operation of the building.

“The STAR benefit is distributed to the building entity and it is responsible to distribute it to the apartment owner and typically, that’s done by way of a credit on a maintenance bill,” she says.

According to Talel, it’s important that boards and managers clearly and effectively communicate to residents how the STAR abatement programs work, to ensure that the benefits of these programs are actually enjoyed by the people they’re intended for.

“Managers should alert the apartment owners of this need to register and they can’t do it for the owners,” she says. “All individuals should have received a specific ID number and what should happen, is they enter that. But of course, like everything else, not everything always gets done the way it should on time. A good manager will stay on top of this.”

Final Thoughts

In February 2014, the Tax Department will give assessors the names of any homeowners who did not register, or who were determined not to be eligible for STAR. The assessment roll entries for these homeowners will not include the STAR exemption.

Although she expects some glitches along the way, from talking with managers and shareholders, Talel says the city’s telephone hotline is providing very good assistance and she recommends that rather than asking your manager about the rules, that you reach out to them directly.

“People should be encouraged to go to them if they have questions or need help completing the registration materials,” she says. “People need to make sure they take advantage of all their purpose for which they are eligible because they are entitled to that benefit and there’s no reason they shouldn’t enroll for it.”

Keith Loria is a freelance writer and a contributor to The Cooperator.

5 Comments

Leave a Comment