There are myriad of ways to get back and forth from Manhattan to Nassau County. Whether you’re driving, taking a train, or bussing it, there’s no shortage of access to what has become an exurban retreat for many commuters and families priced out of Manhattan For these folks, Nassau County seems like a logical place to start looking for an alternative to big city living.

Nassau County encompasses three main towns: Hempstead, North Hempstead and Oyster Bay, along with two cities: Glen Cove and Long Beach. With an area of just 287 square miles, it is bordered by the Atlantic Ocean to its south, Long Island Sound to the north, Suffolk County to the east and Queens County to the west.

Located just 30 miles from Manhattan, the commute to and from Nassau is more than manageable, the housing stock more spacious—albeit rarely more affordable—and depending on whom you ask, the quality of life may seem exponentially better than in Manhattan or Brooklyn. Given its location, it’s no wonder those who enjoy Nassau County and can afford it, stay there. This may be where the problem lies.

The Appeal of the Suburbs

More and more empty-nesters, working families, and New York City expatriates are discovering the charms of Nassau County, from its wineries and old-fashioned farmer’s markets to museums, performing arts and spectator sports events. For families, there are amusement and public parks, beaches, and an excellent public school system, which is a huge attraction.

“Living in Long Beach is almost like living in Manhattan,” says Joyce Coletti, a top broker with Prudential Douglas Elliman who has been handling residential properties in Nassau County for years. “But without all the unwanted excitement. You can walk anywhere you need to go, or get on a train to take you into the city. You almost don’t need a car.”

While all of this is of major importance when deciding where to raise a family, retire or even purchase a first home, for many looking to buy into the Nassau County lifestyle, it’s more complicated. While prices for homes in Nassau aren’t quite as astronomical as they are in New York City proper, they’re very high—and getting higher. Not only that, but actually finding an apartment or home to buy can be a challenge in and of itself—there just doesn’t seem to be much to choose from at any but the highest price point.

There are several possible explanations for this. Long-time Nassau residents who have staked claim to the land have either stayed put—knowing that they’re sitting on potential gold mines—or they’ve snatched up the more affordable housing, which is extremely hard to come by these days. That leaves lots of people wanting in, but being unable to afford much of what little is on the market in Nassau.

Developmental Delays

Bob Wieboldt, executive vice president of the Long Island Builders Institute (LIBI) in Islandia, says that Nassau County today differs greatly from the Nassau County of just a couple of decades ago. “Back in the 1970’s and 80’s,” says Wieboldt, “there were a number of new building projects happening—mostly co-ops and condos,” as well as a number of other affordable multifamily dwellings.

That didn’t necessarily mean that people were flocking to Nassau in record numbers, however.

According to Coletti, “Real estate here was terrible in the 1980s. It started to turn around in Nassau County in 1999, and it has completely gone wild since then. As people discovered that Long Beach as an oceanfront community, they have flocked here for the property and the peace and quiet—and to get away from the hustle and bustle of Manhattan.”

As of today however, development projects to respond to the increased interest seem to be on hold. These same residents who moved in to the area years ago to put down roots outside of the city are still there—and looking to remain in their pleasant surroundings. Those who raised their families in single-family homes don’t seem to need the same amount of room as the once did and are looking to downsize, but also to stay in the area.

“Older residents don’t need the three- and four-bedroom houses that they had while they were raising families,” says Wieboldt, “so as these houses sell, the trend is to either make them over or tear them down and max out the land with newer, larger single-family houses.”

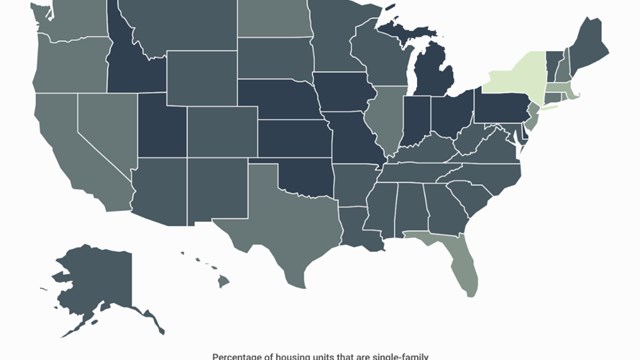

With longtime Nassau residents comprising the highest share of constituents as far as local government is concerned, it may come as little surprise that the new development scene there is not as bustling as it is in other portions of the New York metropolitan area. According to the LIBI, less than 2.5 percent of all spending on new homes and remodeling went to multifamily homes last year—and that basement-level figure is a contributing factor to the lack of affordable housing in the area.

New buildings do occasionally go up, however. A handful of new condos are currently underway in Nassau County—nearly all of them luxury properties. There’s the 95-unit Bel Aire in East Meadow, the 36-unit Aqua in Long Beach, the 92-unit Ocean Grande in Rockaway Park and the 720-unit Meadowbrook Pointe in Westbury.

Coletti is the exclusive listing agent for The Meridian, a brand-new, 36-unit luxury condo in Long Beach that is the most expensive multifamily development in the area to date. Prices for units in the building start in the high $700,000 range and go up to $1.6 million. Amenities include full concierge services, resort-styled outdoor swimming pool, an attended lobby, 24/7 video security, enclosed parking and New York Sports Club memberships for residents. Long Island-based Newman Design Group is the architect.

“The interesting part of this building,” says Coletti, “is that I have sold all of the most expensive units already and the lesser-priced ones are selling a little less quickly. It really says something about what is going on in the area.”

An Issue of Zoning

But as the age demographics of Nassau County have changed over the years from mostly new families and youngish professional types to favor empty-nesters and recent retirees, Wieboldt explains that county officials have actually implemented zoning ordinances—commonly referred to as “golden age zoning”—to address the needs and wishes of this constituency.

According to the official website of the town of Hempstead: “The Town of Hempstead created and adopted the unique Golden Age zoning district to allow affordable housing for senior citizens in a public/private partnership. The Golden Age zone classification promotes senior housing by permitting construction of more units per area than normally allowed. In turn, the private developer agrees to sell the apartments at a price well below the current market value. All apartments have a property tax abatement.”

With what little affordable housing in some Nassau communities being built reserved for seniors, some feel that there’s not much left over for everybody else. With a few exceptions, these senior/luxury types of residential building take up the lion’s share of multifamily construction going up in Nassau County.

According to Paul Atinello, the chief financial officer of Kaled Property Management Corp., a company whose portfolio includes several properties in Nassau County, this means that unlike in the five boroughs, co-op and condo development in Nassau is somewhat sluggish. “While things are going well in Nassau County, there are some challenges these days to co-op and condo living.”

Because sky-high energy prices are making it difficult to get capital improvement projects passed in these properties, Atinello adds that “energy is a driving force which has a trickle-down effect on all other goods and services.” This can add a huge burden to managing such properties when an especially hot summer or cold winter is factored into the equation. Challenges like these, which affect existing multifamily buildings, make building more multifamily developments seem a less appealing proposition in Nassau—at least for the time being.

However, says Atinello, there is an upside to co-op and condo living when the single-family and detached home market is enjoying such a boom. “With the housing market soaring and oftentimes pricing younger folks out, co-ops and condos become much more affordable—and that should help it start back on the rise.”

And properties are being bought and sold at a relatively brisk rate, according to numbers from Prudential Douglas Elliman. Between July 2005 and July 2006, nearly 200 one- and two-bedroom co-ops and condos have changed hands in Nassau County, with the most expensive topping $1.5 million and the most modest selling for around $239,000.

Single-family homes are more the norm in Nassau, with some 253 homes sold between 2005 and 2006. These dwellings ranged in size from just two bedrooms to six or more, and started at around $320,000. The most expensive home purchase within that period cost the buyer $2.65 million.

But as the price-points for homes in Nassau indicate, “affordability” is a relative term. “Community issues and zoning restrictions aren’t allowing us to build the kind of affordable housing people need,” says Wieboldt.

Other Challenges

There are other issues driving the cost of construction up as well. A significant lack of community infrastructure doesn’t ease the burden. Sewers, transportation around the area, water and electricity are just some of the necessary (and expensive) elements needed for rejuvenating and further developing parts of Nassau County. “The cost of land is so expensive here,” says Wieboldt, “that having one house per acre doesn’t help in putting into place the things that make a real booming community. There’s a real black cloud over apartment construction in that county.”

On the other hand, with such restrictions in place—along with prohibitively expensive land costs and underwhelming infrastructure, new developments are not easy to get underway. Given the ratio of new single-family homes to multifamily units currently under construction, you may be able to find a co-op or condo in Nassau County—but whether you can afford it is another question.

But to some observers at least, the prices and development slow-down in Nassau County is just a function of supply-and-demand.

“We don’t sell houses by square-foot here,” says Coletti. “We sell by proximity to the ocean. The closer you are, the more expensive the property. It boils down to if you want to live in an area like Long Beach, you’re going to have to pay for that kind of property.” n

David Garry is a freelance writer living in New York City.

Leave a Comment