If you live in the United States and watch television, you are undoubtedly aware that every January, right before the New Year, the Holiday Season advertising tapers off and the Tax Season advertising begins. From around December 30th to April 15th, America’s accountants and its taxpayers are making lists, researching loopholes and filing returns. This is even truer for co-op and condominium communities and HOAs. These residential entities face a whole list of additional filing requirements for fees and inspections as well as taxes that individual taxpayers are not subject to.

Federal Filing

Say, “Income Tax” and most immediately think of April 15th, tax day. The law governing the filing of annual federal tax returns for co-ops, condos and HOAs under forms 1120 and 1120H is a little different, however. As Stuart Halper, President of Impact Real Estate Management with offices in Manhattan, Queens, Westchester and Long Island explains, “Federal income tax returns for these types of corporations must be filed two-and-one-half months after the end of the corporation’s fiscal year. If that fiscal year conforms with the calendar year and the end of the fiscal year is December 31st , the tax returns are due on March 15th,” not April 15th when individual returns are due. “You are entitled to an annual six month extension,” Halper continues, “which in cases where the fiscal year ends on December 31st will be September 15.” Halper adds that it’s “more common than not” for co-ops, condos and HOAs to file for such an extension.

Jayson Prisand, a partner at Prisand, Mellina, Unterlack & Co., LLP, a certified public accounting firm located in Plainview, New York, says frankly, “It has to do with accountants. The first step [of the filing process] is preparing the audit. The second step is getting the board to approve the audit and finalize it—and that can take some time. Boards may not meet more than once a month, so even if the accountant’s work is done, the board may not have the opportunity to review the report. That can hold things up. There’s nothing wrong with filing an extension. So, typically, we focus on the audit and put most entities on extension. Then, when we get out of audit season, we have more time to complete the tax return, which tend to be completed in the summer.”

Long gone are the days of once-a-year, hand collected revenue and expense reports. The collection of data for income tax filings has become a year-round and very exact process. Halper explains his company’s system: “We send monthly management reports to the board and their accountants, so they’re receiving up to date information all year round, and can start looking at the data at any point. The monthly report contains monthly revenue and expense figures plus year-to-date and budgeted forward analysis. If there are irregularities, they can see them.”

Cindy Petrenko, the owner of Complete Property Management of Vernon, New Jersey has been managing condo developments for over 15 years. “The gathering of information for the actual filings for the annual audit is the responsibility of the agent,” she says. “Any manager, big or small, does the same data collection for the association. At the end of the fiscal year there is usually an independent audit. The auditor works with the managing agent to compile the information for that. Most managing agents have software to help do this.”

Despite the fact that most board assign responsibility for data collection and organization to their managing agents, “The condo board is ultimately responsible for carrying out the requirements to keep the [condo, co-op, or HOA] in regulatory compliance,” says David A. Levy, a certified public accountant based in Needham, Massachusetts. “They hire the management company and they should delegate the responsibility for...compliance to the management company, but the ultimate responsibility is still with the board.”

The State Side

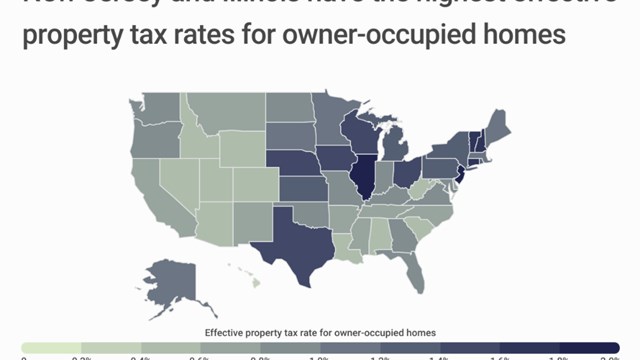

The question of state income tax filings is a bit more complicated, as each state has its own requirements; but some are remarkably similar. Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming have no state level income taxes. New Hampshire and Tennessee have state level taxes on dividends and income from investments, but not ordinary income. All other 41 states have a state income tax.

New York State requires that co-ops, condos and HOAs file annual state income tax returns as corporations. The due date is the 15th day of the 4th month after the end of the corporate fiscal year. Massachusetts has the same requirement. Maine, Vermont, Rhode Island, Connecticut and Illinois require filing by the 15th day of the 3rd month following the end of the corporation’s fiscal year. Assuming that most co-op, condo and HOA corporations operate on a fiscal year aligned with the calendar year, that’s usually March 15th.

According to Community Property Advisor, the quarterly publication by Wilkin and Guttenplan, P.C., a public accounting firm located in East Brunswick New Jersey, “Most New Jersey condominium and homeowner associations are not required to file state tax returns as they are incorporated under Title 15A.” New Hampshire does not require state income tax filings as there is no state income tax on non-dividend income or income from investments. Like federal returns, these returns are prepared by a corporation’s accountant and are ultimately signed off on by the board.

Real Estate Taxes

The major difference between condos and co-ops is their ownership structure. Condominium owners own their units outright, and have an interest in the ownership of the common areas. A co-op owner owns shares in a corporation that owns the co-op property, and is assigned what is known as a proprietary lease for their unit. As such, the assignment and payment of real estate taxes is handled in very different ways. Condominium owners are billed directly from the taxing authority - usually a city, town or other municipality - and are directly responsible for the payment of their own taxes. Often, the bank that holds the individual condominium loan will escrow for and pay the real estate taxes on the unit for the owner, as is commonly done with single-family homes and even large commercial properties.

Co-ops are different. Because the entire property is a single taxable unit, there is one assessment and one tax bill for the whole community. In New York City, where co-ops are much more common than in other parts of the country, real estate taxes “are paid either quarterly or bi-annually,” says Halper. “Some co-ops, because they have underlying permanent mortgages, escrow their taxes with the bank that holds the mortgage, as is done with a home mortgage. Some banks don’t escrow and some co-ops don’t have underlying mortgages. In those cases, the managing agent must get it paid. You can’t miss that payment.”

Payroll Taxes

Payroll taxes and other related labor expenses, while an ongoing expense, are also scheduled filings. “Form 941 must be filed quarterly with the federal government, 15 days after the end of the quarter, for all employees of the association or co-op corporation,” reports Halper. “We require all of our buildings to use a payroll service. These payroll services make sure the filings are done on time, and pay the building’s payroll taxes weekly by electronic transfer to the federal government.” Additionally, all co-op, condo and HOAs must carry insurance for workman’s compensation and disability, which is generally arranged by the managing agent. Unemployment insurance premiums are also handled by the payroll service that remits the taxes for the association.

Penalties

Interestingly, penalties for late filings or for not filing are more likely with non-tax items (like facade or elevator inspections) than with tax items. According to Halper, “Missing an elevator inspection in New York City can result in a $5,000 fine. Local Law 11 non-compliance can result in a $10,000 late filing fee.”

However, “Since most associations employ an accountant,” says Levy, “it would be very unusual to have a purposeful misfiling or non-filing of required [tax] items.” As a matter of course, accountants file for extensions when filing dates can’t be met. Therefore, it is highly unusual for a building or association to be fined for non-payment or unfiled federal or state taxes.

“Though the IRS has a well-earned bad reputation,” says Mark Love, President of M Love & Associates, a CPA firm based in Wooster Massachusetts, “these are reasonable people, and if there is a reasonable cause that you can demonstrate, they can be lenient in abating penalties - more than you would imagine, actually.”

New York

Perhaps the most unique aspect of the tax and filing process in New York City is that there are many more co-ops here than are found in other parts of the nation. As mentioned above, this results in an additional layer of watchfulness for managing agents when it comes to real estate taxes. They must be vigilant that those payments are made on time in the event that the underlying mortgage lender is not escrowing for taxes with mortgage payments. Additionally, compliance with benchmarking rules under Local Laws 84 and 87 are a top priority in New York City. The annual analysis performed under Local Law 84 carries an initial penalty of $500 that can increase to up to $2,000. Local Law 87 which requires a filing every ten years can result in a fine of up to $115,000 depending on how long the filing is delayed. Boards and managers must keep in mind that many of the building functions reviewed in this report can take up to a year to test.

New England

Unlike other markets New England, particularly Boston, is home to many very small condominium associations, sometimes containing only two or three units. “There are tons of them,” says Levy. This can pose a unique problem for the processing of filings and deadlines. Small associations often can’t afford the level of outsourced services that larger condominium associations can. “Forty units is the breaking point,” adds Levy. “Under forty units, many associations choose self-management or partial self-management.” Love cautions against this. “At the risk of sounding shameless,” he says, “when a condo association is self-managed and they are trying to save money and have someone in the membership file the tax return, they usually file late, don’t file, or file incorrectly. It is good policy and money well spent to have a CPA or a credentialed tax preparer prepare those returns.”

New Jersey

Supervising the array of filings and deadlines for associations in New Jersey brings some unique challenges for boards and managers. Unlike in a single large city such as New York, Boston or Chicago, managing agents in New Jersey may have properties in many different municipalities, subject to differing rules at both the local and sometimes county levels. According to Petrenko, “Inspections vary by city. They are usually conducted once a year, around the anniversary of the last inspection. There are also fees paid to the state for life hazard use annually for some properties.” ‘Life hazard use’ is defined by the state as a building or structure that may constitute a potential risk to human life, public welfare or firefighters such as high-rise buildings. Petrenko also says that, “New Jersey requires an inspection of properties every five years by the State Department of Community Affairs.”

Chicagoland

Jim Stoller, President & CEO of The Building Group in Chicago explains that “In addition to the federal and state required tax filings, condo and co-op associations must file an annual report with the State of Illinois. Chicago, like New York and Boston, “has a long list of other filing requirements, including inspections for sidewalks, fire escapes, fire pumps, elevators and boilers,” Stoller continues. “Permits and licenses are required for sidewalk vaults, building signs, parking signage and related regulations and the reselling of electricity. There are also co-op and condo taxes.”

Mark Love may have said it best in his appraisal of how the management of co-op, condo and HOA filings has evolved. “We have found that in the past ten years condominium associations have begun to be run like small businesses.” While these associations and the buildings they represent may in fact be home to many people, the form of ownership has blurred the line between home and business, and as always the case in business, efficiency and vigilance makes for good management—particularly when it comes to knowing what to file, with whom, and when.

A.J. Sidransky is a published novelist and staff reporter for The Cooperator.

2 Comments

Leave a Comment