The Tax Cuts and Jobs Act of 2017 represents the first major restructuring of federal income taxes since 1986, and ushers in serious changes to how co-op, condo, and HOA owners will benefit from home ownership. In many cases, the new law will not help these owners due to its focus on eliminating itemized deductions that have historically accrued to and benefited homeowners over renters.

The (Former?) Benefits of Home Ownership

Since the end of World War II and the beginnings of the post-war expansion, federal tax law has been used to guide Americans toward the ‘American Dream’— the opportunity to own one’s own home, grow their equity, and by association provide both a financial cushion for later years and to create generational wealth. Mortgage interest as a deductible item on federal income taxes has been the bedrock of this policy. It provided owners with an opportunity to ‘subsidize’ their tax bill by lowering the amount of income subject to tax. Beside encouraging the purchase of homes throughout the nation’s suburbs, the obvious benefit of tax savings stimulated the trend of purchasing co-op and condo units in urban areas. In short, the policy clearly incentivized renters to become owners.

The federal income tax calculation provides the taxpayer the option of choosing what’s known as a standard deduction, or the opportunity to itemize. Itemizing of deductions on Schedule A provided deductions for such expenses as mortgage interest, state and local taxes, some medical expenses, and charitable deductions, to name a few. The standard deduction until December 31, 2017 was $12,100 for a married couple filing jointly. Single taxpayers were provided a standard deduction of $6,350.

The new tax act increases the standard deduction for single taxpayers to $12,000, and $24,000 for married couples filing jointly. While this may sound like a large increase — for tax-payers in high-tax, high cost-of-living areas like New York, New Jersey, Chicago, and Boston — it is accompanied by a commensurate loss of deductible expenses that previously compensated them for living in a more expensive location.

Changes to Deductible Expenses

State and Local Taxes

According to Karen Sackstein, a certified public accountant and principal with The Condo Queens, an accounting firm based in Fair Lawn, New Jersey: “The two major changes in the new tax law that will affect co-op and condo owners are to the mortgage interest deduction and to the deduction for state and local taxes — also known by the acronym SALT. The biggest change for people in the New Jersey area is the deduction limitations for real estate taxes. In the past, for primary residences, the taxpayer was able to deduct 100 percent of their real estate taxes and their state income taxes — and that’s what people did. The average real estate tax deduction in New Jersey last year was $9,500. Under the new law, the maximum deduction for both real estate tax and state and local taxes is $10,000.”

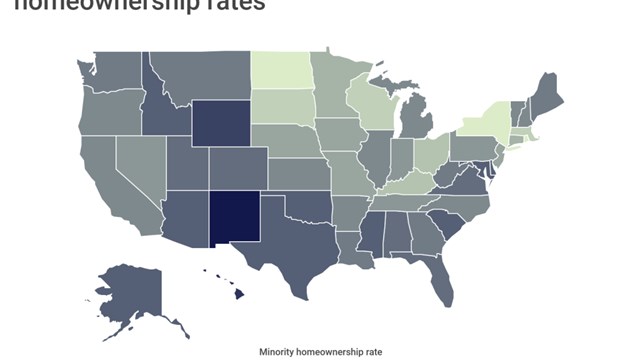

Clearly, many taxpayers will not have the benefit of deducting the total of both their state and local income taxes and their real estate taxes. In many cases, they will not have the benefit of deducting all of either or any — especially in high-tax areas such as New York, New Jersey, Massachusetts, and parts of Illinois.

Chris Nyborg, a certified public accountant based in Batavia, Illinois, recommended that her clients, including co-op corporations and condo associations “prepay their real estate taxes for 2018 in 2017 if they could afford to,” so as to receive the maximum benefit from the deduction before the rules change. “So far,” she says, “the IRS has accepted the payments for the 2017 deductions. The exception being that Cook County (which includes the City of Chicago) would only allow any association to prepay one half of their 2018 tax bill. The county has the authority on their own to make that rule.”

Mortgage Interest Deduction

Another change affecting co-op and condo owners, according to Andrew Sgro, an audit manager at accounting firm Prager Metis, which has offices in New York and New Jersey, is “the change to the mortgage interest deduction. The limitation on mortgage interest deductibility has been reduced from $1,000,000 to $750,0000 for all loans taken after December 31, 2017. Older loans are grandfathered under the new law.”

What this means in practical terms is that owners who take very large mortgages on their homes, co-ops, condos or HOA units will be permitted to deduct interest only up to $750,000 of principal. Interest charged on dollars over that limit will not add additional benefit in tax savings. This change clearly affects the upper end of the market. “We foresee the higher end missing out more on this change,” says Sgro. “We won’t know for another tax season what the ultimate net effect of this change may be on unit prices, between the lowering of the overall tax rate and the reduction in interest deductibility.”

Mark Love of the accounting firm M Love & Associates, which has branches in Massachusetts, agrees. “Condo owners are impacted most by the change in SALT deductions,” he says, “now maxed out at $10,000. They are also impacted by the lower ceiling on the mortgage interest deduction.” However, he does note that “the average owner doesn’t carry a $750,000 mortgage.”

Changes to Home Equity Loan Deductions

Another area impacted by the changes wrought by the new law is the deductibility of interest paid on home equity loans and home equity lines of credit (HELOCs). Previously, these were entirely deductible, as was any interest paid on any mortgage on a primary residence. Co-op and condominium owners all over the country utilized this instrument to access the equity otherwise locked into their units for everything from new kitchens to paying for a child’s education. While the changes to the mortgage interest deductions up to $750,000 and the changes to SALT deductions have been reported on extensively, this change has not. And this change is not grandfathered. According to the professionals interviewed for this article, interest paid on home equity loans taken before December 31, 2017 will no longer qualify for deductions, with limited exceptions.

“There is a limitation on HELOCs,” says Love. “But most condominium owners in New England don’t have these. It has a greater impact on the single-family home market. Removing equity is uncommon in New England. Old Yankee New Englanders think ‘debt’ is a four-letter word. They believe the quicker you pay down to zero, the better.”

Sackstein views the situation a bit differently. “Associations that want to get large projects done but can’t borrow for whatever reason, may file a special assessment and tell owners they can take out home equity instruments to cover their assessment and get a deduction for it,” she says. “Now they can’t [get that deduction].” Clearly, there are regional differences of opinion about the use of this financing instrument.

Potential Effects of the Changes

Across the board, our experts have said that the jury is still out on what the overall and longer-term effects will be of the Tax Cuts and Jobs Act of 2017. At least one year is needed before any real opinion formulated on concrete data can be reached. In the meantime, other factors may affect the market as well.

Nyborg, who works closely with many high-end luxury condo and co-op communities, believes the upward pressure on interest rates may have as big an impact on the condo market as the change in deductible tax benefits. “In Chicago,” she says, “there are a lot of condos going up, under construction. I don’t believe taxes will influence purchasing decisions as much as rising interest rates. That might have a greater impact on purchasing units. Particularly for luxury properties, rising rates are the issue. Luxury units are over the $1,000,000 threshold of the previous law anyway.” Overall, Nyborg doesn’t believe the change to deductible expenses will affect high-end buyers. “High-end buyers are more interested in the lowering of their tax rate. Many buy all cash anyway — especially foreign buyers.”

According to Love, “While rates are beginning to creep up, it’s still a good market for the seller. Prospective buyers are acting quicker to lock in a rate. If they act quickly, that stabilizes or increases prices. It’s a seller’s market because of what’s happening with respect to mortgage rates right now.”

Another possible change resulting from the tax reform may be that fewer people will have enough total dollar deductions to itemize, and will be forced to use the new standard deduction. This was the intent of the law to begin with. Ultimately, the federal government will collect more tax dollars through the more restrictive deduction rules.

Sackstein believes the new rules will lead to more selling. “People will move out of states where they’ve lost deductions.” She compares her own real estate taxes in excess of $10,000 per year to her sister’s in Florida, which are far less. “If people who have lived in a home for a long time no longer have a large mortgage deduction, and counted on their real estate tax deduction but no longer have the benefit of that, they will be getting out.” One of the longer term possible effects of the bill may be to increase supply, creating a buyer’s market that in effect would bring lower prices, a negative for the housing industry and homeowners, including those in co-ops, condos, and HOAs.

In conclusion, it’s too soon to tell for certain what the overall impact of the Tax Cuts and Jobs Act of 2017 will be on the co-op, condo and HOA universe. One thing we know for sure is that for the average owner in certain locations, the benefits of ownership have been reduced.

A.J. Sidransky is a writer/reporter with The Cooperator, and the author of several published novels.

Leave a Comment