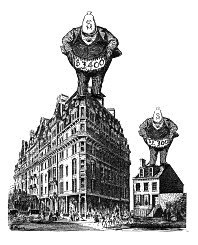

The old saying goes that the only two sure things in life are death and taxes. According to the experts, for owners of co-ops and condos in New York City, there's a third inevitability: you're going to be taxed at a higher rate than owners of single-family homes.

Pared down to its basics, the disparity of the city's real estate structure seems simple. Single, two- and three-family homeowners pay less in property taxes than condo and co-op owners whose apartments are of equal value. To compensate for the apparent inequity, co-op and condo owners receive government-mandated tax abatements.

One might think that would settle the issue, but the reality is that there's nothing "simple" about real estate taxes in New York. Talk to a few experts, and the people working for tax equity, and the more you learn, the more complicated things get. Some experts even disagree as to how unjust the inequity is.

Unequal Taxation

How did this current system of taxation come about? Back in 1981, the state instituted property tax legislation called S7000A. This legislation came about in response to a lawsuit questioning the constitutionality of assessment of property values all across the state, including New York City. Even though it was created for this purpose, "Under S7000A, the city's property tax has grown even more tilted in favor of owners of one-, two-, and three-family homes than it had been in 1981," according to a December 2006 report by the Independent Budget Office (IBO), a non-partisan, publicly-funded agency that offers budgetary, economic, and policy analysis for city residents and elected officials.

The legislation created the current system that divides property into 4 classes, which are all taxed on a different share of each class's assessed value. One-, two- and three-family residential property and small condominiums (3 or fewer units) are considered Class 1. According to the Department of Finance, there are currently 691,736 Class 1 parcels (or structures), and 1,051,733 Class 1 units within those structures in the city. Cooperatives and condominiums are considered Class 2 properties, which includes all multiple dwellings. The Department of Finance identifies 186,974 of these Class 2 parcels, and 1,742,068 units within those parcels. Class 3 consists of regulated utility property. Class 4 consists of all other real property, such as office buildings, factories, stores and vacant land.

"If you're in tax Class 1, your assessment can't be raised more than six percent per year, or more than 20 percent in any five-year period," says Paul Korngold of Tuchman Korngold Weiss Lippman & Gelles, a Manhattan law firm specializing in New York City real estate tax matters. Essentially, even if the market value of a home doubles or triples, a tax assessment cannot be raised to reflect that because the cap regulating assessment increases actually limits the long term increases to 4 percent per year when you factor in the five year 20 percent cap.

Complicating the equation, according to Korngold, is that private homes were already "grossly under-assessed" in 1981. The value of real estate, he says, has increased at a much faster rate than the 4 percent per year cap.

According to Elliott Meisel, an attorney with Brill & Meisel in Manhattan, condominiums and co-ops, many of which are new construction, are getting assessed at new, very high rates.

"So they start off at very high rates," says Meisel, "where even if there is an intent to bring the preexisting private homes to an equitable equivalency, it would take many years because they can only increase the [assessed values] on those properties [six percent annually]. There's an extraordinary inequity, the entire real estate tax system in New York City is just plain broke."

As an illustration of the situation, take a house that's worth $500,000. The city says it should be assessed at six percent, or $30,000 per year.

"But the reality is that many of these homes are assessed at maybe $15,000," Korngold says. "And the reason for that is that they were assessed at only $7,500 25 years ago." Under the 20 percent five-year cap, it would take 25 years for the property to get assessed at $30,000, according to Korngold. By that time, the house is certain to be worth more than $500,000.

For the purpose of simplification, IBO provides an example of the tax difference in just one fiscal year using their tax calculations—a system called the effective tax rate, which is the tax paid per $100 of market value. Using the 2007 assessment roll, IBO estimates that a one-, two- or three-family house worth $500,000 would pay $2,300 in taxes and a co-op worth that same $500,000 would pay $3,400.

Shareholders as Renters

"[Co-ops and condos are] assessed as if they're rentals," Korngold says. "And the reason for this is really to protect them."

That may sound strange, but Korngold explains the reason for assessing co-ops and condos as rentals was the legislation's reaction to a court ruling in Westchester County more than twenty-five years ago. A judge ruled at that time that the proper way to value a co-op or condo is to add up the sales price of all the units, and then add the underlying mortgage.

"That's a much, much higher value than what the building's assessed at," Korngold says. "You have buildings in the city, particularly in Manhattan, where co-ops are selling for more than the assessed value of the entire building. If this judge's decision became the law, this would cause a huge increase in taxes for co-ops [and condos]."

To prevent an undue burden on co-ops and condos, the state legislature enacted Section 581 in 1981. It said the value of a co-op or condo should be assessed as a rental, in order to avoid being assessed as a whole with the building. Co-ops and condos were then assessed as income-producing properties.

"Does that mean that co-ops [and condos] are completely unfairly assessed?" Korngold asks. "Not exactly." In order to mitigate the tax disparities for unit owners and shareholders, the Cooperative and Condominium Abatement plan was created.

Bring in the Abatements

In 1990, the Council of New York Cooperatives and Condominiums (CNYC) formed the Action Committee for Reasonable Real Estate Taxes to address the deep disparity between the taxes paid by co-op and condo dwellers and those of private homeowners. The committee discovered that co-op and condo apartments in buildings containing more than three units were paying three to five times more property tax than single-family homes of comparable value.

"Our position is that co-ops and condos are the same, from a tax point of view, as one-, two- and three-family homes," says Martin Karp, chairman of CNYC's Action Committee for Reasonable Real Estate Taxes. "Abatements [were looked at] as a way of correcting this disparity."

The abatement program was enacted in 1996 to lower the tax rate for many property Class 2 apartment owners so that they could come closer to that of homeowners in property Class 1. Karp adds that the tax abatement solution was only a temporary fix on a long-term problem. Abatements were only supposed to be given for three years, until the city proposed a better plan for taxation. The abatement program has been renewed three times since then, and expires on June 30, 2008.

Even though the abatements have served as a partial solution to the tax disparities for so long, some believe it has created even more inequity.

First of all, not all co-ops and condos are eligible for the abatements. Those not eligible include people who own more than three apartments in a condo or co-op and owners eligible for other benefits such as J-51, 421-a, or 421-b, if those benefits exceed the abatement.

Karp says apartments with an average assessed value of $15,000 or less receive a 25 percent abatement, with all others getting a 17.5 percent abatement. He adds that as assessed values increased, small apartments moved out of the $15,000 class fairly quickly.

"The reason for the two percentages was that it was recognized that small apartments had a larger inequity relative to the more valuable apartments," Karp says.

However, according to Karp, "The flat 17.5 and 25 percent abatement does not treat the apartments that need it most. Abatements are not distributed equitably."

According to the IBO, "Out of the $293 million spent on the abatement this year, $156 million went to apartment owners whose effective tax rates were already below that of homeowners or who did not need the full abatement to reach the homeowners' level. And much of this excess abatement spending went to owners on the Upper East Side and Upper West Side of Manhattan. Yet many Brooklyn and Queens co-op and condo owners still have higher tax burdens than homeowners."

However, the CNYC's Action Committee contests this finding.

"Too many makeshift band-aid efforts to fix the law have probably increased the inequity rather than diminished it," says Meisel.

So why have abatements been renewed as a solution three times? Instead of re-evaluating the tax inequality by changing the entire system, state legislators offer a short-term solution. "From a legislative or legal point of view, it's easier to vote in an abatement than to re-do all of the state and city tax policies," Karp says.

Karp says that if the abatements are continued, they should be modified in order to achieve more equitable distribution.

When asked if there's concern that the abatements could simply be repealed, Karp says that technically, it would be relatively easy for the city to end them—no new legislation would be required to do so—but it wouldn't be easy because of objections from the Action Committee.

"I don't think they will allow the current system to expire without some other change," says Meisel.

"But the abatements could die, that's correct," Karp says. "Our effort is to get an equitable extension."

Digging Deeper

In addressing the questions as to whether there's a statistical difference in the taxes paid between private homeowners and co-ops, Korngold gives an example of a single family home and a co-op both worth $500,000 (acknowledging that finding a $500,000 co-op in Manhattan is pretty much impossible nowadays). He speculates as to what would happen if Class 1 properties were not capped at six percent and were allowed to rise along with their market value.

"What would happen to the value of the private house if all of a sudden, they doubled the real estate tax on it?" Korngold asks. "Would someone still pay $500,000 for that house? Probably not. So maybe the discrepancy is still a discrepancy, but all of a sudden if the private home had to pay a lot more taxes, the value of that private home would drop."

Korngold adds that if you then added the tax to a private home and took it away from the co-ops and condos, that would result in the condo and co-op values increasing, while the home's would go down. "The main reason co-op [and condo] taxes have gone up is because the real estate market in New York is hot, hot and hot," he adds.

When asked if those co-ops and condos in some parts of Manhattan, where the prices have gotten so high, are assessed unfairly, Korngold says he's not sure. "Maybe, maybe not," he says. "Why should a guy who lives in a $10 million apartment on Park Avenue, be getting 17.5 percent back on his taxes from the city?" he asks rhetorically.

Furthermore, Korngold thinks it's possible that if tax rates were based on adding the values of all individual co-ops and condos in one building, rates in Manhattan would go up, though they'd likely go down in other boroughs.

"At the end of the day, I'm not sure who has an advantage," Korngold says. "If you just look at the bare surface, a $500,000 private home, on average, is going to pay less taxes than the average $500,000 co-op. But as I said, there are all these other things you have to look at, what special programs people get, are they assessed fairly?"

Finally, there's the factor of co-ops and condos taking in additional income. People moving into brand-new co-ops and condos are eligible for the 421-a benefit, which grants a partial tax exemption to developers of new construction for a period of 10, 15 or 25 years, and results in minimal tax paying for the buyers.

Co-op owners can also get a break by improving the property, like putting in new windows, a perk denied private homeowners. Co-op residents also benefit from businesses that rent spaces in their buildings. On the other hand, an owner of a two- or three-family house, which is taxed as a private residence, can gain income by renting out space.

Determining a perfect tax system seems no easy task. Under the current class system, assessment caps are placed without attention to rising market values and the abatement program is not a long-term solution. Could the system be changed to classify all properties under one tax rate? Or will Class 1 property assessments remain capped?

According to Jonathan Harkavy, chief of staff for state Assemblyman Vito Lopez, chairman of the Assembly's Housing Committee, there have been no "major substantive discussions" about the future of the abatement program yet, as most of the attention is now on the 421-a benefit, which expires this year.

Crystal Proenza is associate editor of The Cooperator. Anthony Stoeckert is a freelance writer and a frequent contributor.

Comments

Leave a Comment