According to a recent study by consulting firm Construction Coverage, the cost of buying a home in the New York City market is nearly half again as expensive as renting one. Then findings confirm a trend that’s been ongoing for a number of years, but which has accelerated as interest rates have climbed to fight inflation.

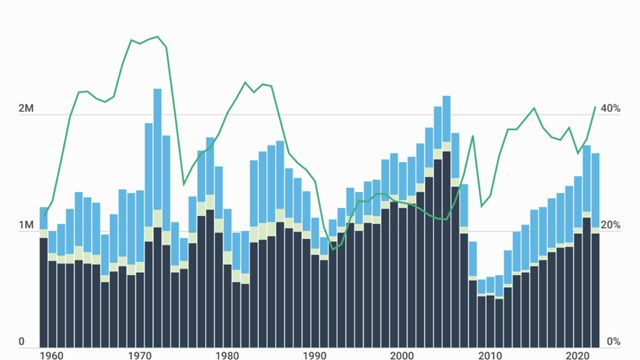

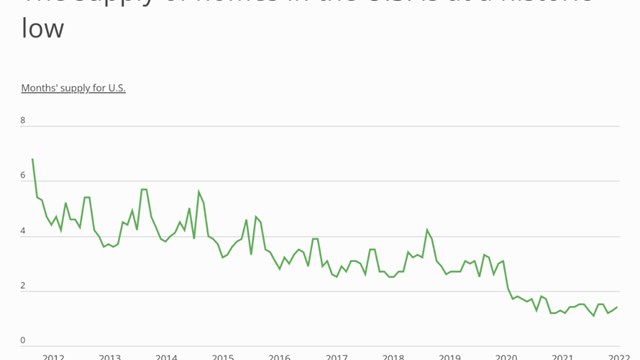

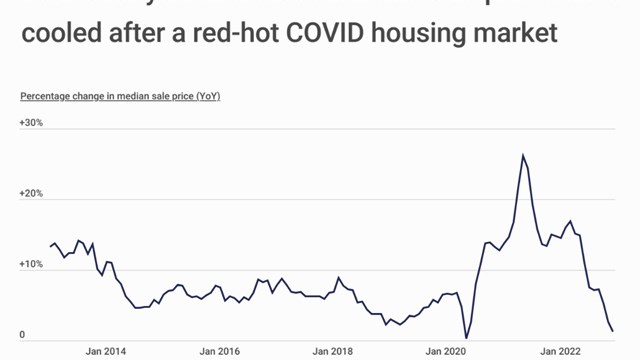

For many years, the typical monthly costs of buying a home—after accounting for sales prices, mortgage rates, and property taxes—were well below the costs of typical rents in the U.S. Even as home prices began to increase amid the competitive market in 2020 and 2021, low interest rates still made buying more affordable.

But beginning in 2022, the combination of high home prices and high interest rates tilted the scales in favor of renting. And as of November 2023, the typical monthly payment for a home in the U.S. was more than 22% higher than the typical monthly rent.

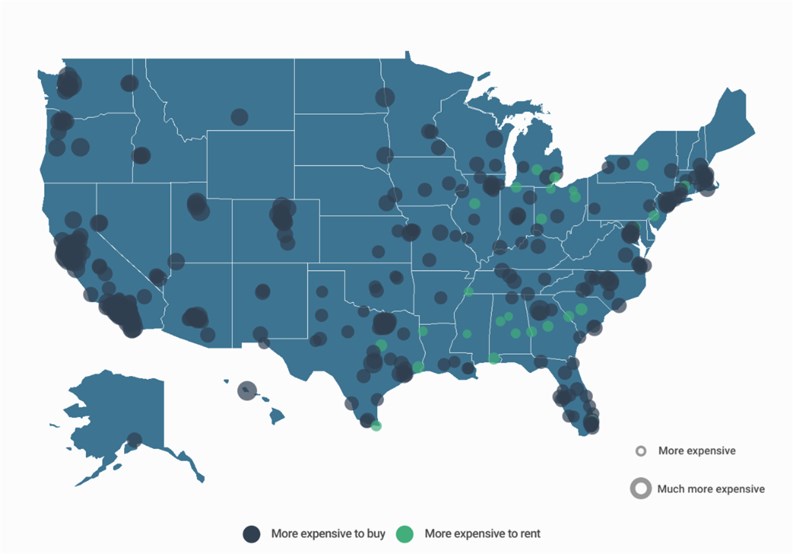

Researchers compared the cost of buying a home with renting one in over 300 U.S. cities and ranked locations accordingly.

These are the key takeaways from the report for New York City:

Out of the 338 U.S. cities included in the analysis, only 28 are currently more affordable for buyers than renters

New York City isn't one of them: the median monthly mortgage payment is $4,984, while its median monthly rent is $3,424

Overall, it costs residents 45.6% more to buy versus rent in New York City, making it much more affordable for renters than homebuyers

Click here to read the complete results of the analysis, with data on more thank 300 U.S. cities and nearly 1,000 counties.

Leave a Comment